Prospects for the Non-GMO soybean harvest 2023/24

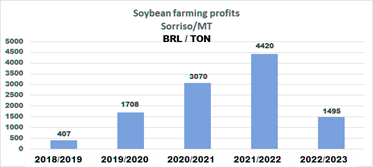

After a very rewarding cycle in 2021/2022, when non-GMO premium prices reached values over USD 200.00/ton, the beginning of 2023 brought a much less attractive scenario.

Unsurprisingly, history repeated itself once again and the premium melted in the face of excessive production. By January 2023, premiums above the 60 kg bag (the standard for domestic trade in Brazil) were virtually non-existent.

As the year progressed and the harvest in Brazil came to an end, most of the farmers who had committed to the non-GMO supply struggled to find a buyer. Pressured by the subsequent corn crop, producers are selling the “old” crop on the commodity market, at a very low or no premium.

The window of opportunity for decision making is narrowing, with planting starting in September and farmers needing to secure their seeds now. At the buyers’ end, clear communication of demand would be required. However, with framework agreements in place for the current trading year and supply still reflecting the high production in 2022/23, traders are in many cases speculating, unaware of the dynamics within the Brazilian farming arena. Farmers are delaying their decision on which technology to use (GM or non-GM) for as long as they can, commitment is needed to reach the 4 million tons of the last harvest.

However, there are some new facts though, that might play an extenuating role in the current challenging scenario for the non-GMO segment. First, high-performance non-GMO seeds developed over the past decade have finally reached the market, offering very competitive features and yields compared to GM varieties.

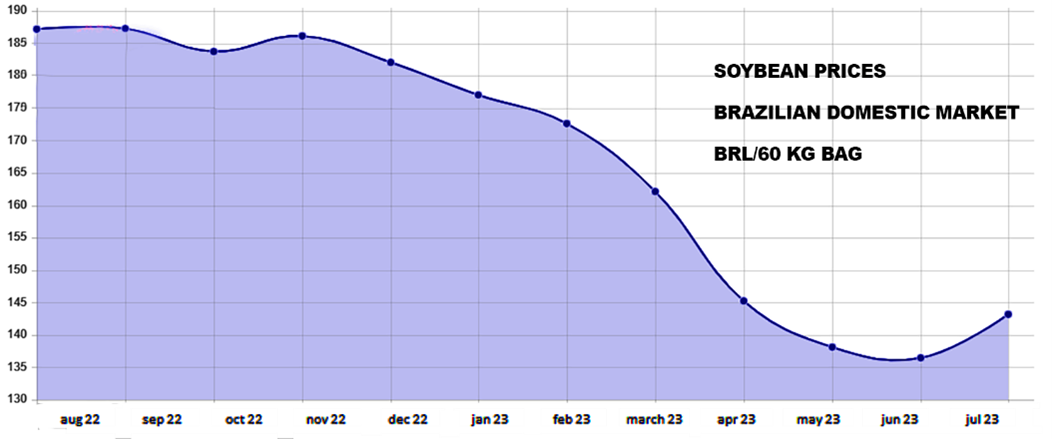

Second, prices in the domestic market have decreased significantly. The current price scenario is one of reduced margins, where the non-GMO premium will have a greater impact as an additional revenue driver.

The summer months have also brought some movement to the market. Crushers are making their first moves towards the next crop, pushing premiums in the local market, this may represent an indicator of a more positive scenario.

Third, the varieties developed for the southern market have performed remarkably well in terms of cost and yield. Some farmers, particularly in Paraná, are growing non-GMO soybeans based on the efficiency they have seen rather than on premium. The perspective of performance-based choices for non-GMO is also present in the Cerrado region. However, these farmers are not always on the radar, and their production might add unexpected volumes to Brazilian non-GMO production.

Finally, given the combination of low soybean prices, and meagre premiums compared to a not-so-distant scenario of extravagant rewards paid to non-GMO farmers, decisions that should be taken now are being delayed and may remain undecided until September.

The current saying spreading in Mato Grosso is “there is no good timing for bad business”. The waiting game could push seed purchases for the 2023/24 cycle unprecedently into September, when planting begins in the Cerrado.

On the buyers’ side, a reduced supply of beans not only means high prices but usually brings undesired havoc to the market that can be avoided.

It is crucial to have all suppliers of non-GMO materials working as a group to ensure the sustainability of the segment. If Brazil is logistically closer to western Atlantic ports, Ukraine is much better located to supply crushers in southern Germany, northern Italy, and parts of eastern Europe, but it may be challenging to reach Norway, for instance. Italian crushers are close to small North African suppliers such as Nigeria, Ghana, and Togo. There have been shipments of non-GMO material from Uruguay and Argentina. Paraguay used to be a solid supplier and India is also a potential exporter.

The European non-GMO market needs to have multiple sources. If any of the big players bail out, the remaining volumes may not be enough to ensure the sustainability of the segment as the demand could be bigger than the total volume of the current suppliers combined. Rather than disputing positions, it is crucial that the international community of non-GMO producers work united to regain markets that have been disrupted by supply crises in the past and to create new ones, such as increased transparency of protein products, which currently are mostly traded without traceability systems.

There is much that can be achieved in a collective effort: It is time for cooperation.