Updates on Brazil’s Non-GMO Soybean Sector

Non-GMO Soybean Update

The supply of non-GMO soybeans in Brazil is currently facing its most complex scenario in over 20 years. A shortage of non-GMO seeds, combined with uncertainty over future purchase commitments, has constrained a potential increase in cultivated volumes, leaving the supply situation largely dependent on farmers’ decisions at the field level. Nevertheless, the number of Brazilian farmers planting non-GMO soybeans has increased, driven by the prospect of higher profit margins.

Global challenges

In the wider soybean market, prices have declined sharply due to oversupply, falling from almost BRL 200 per 60 kg bag in 2021 to approximately BRL 130 at the beginning of the 2025 season (Paranaguá basis). Prices briefly rebounded in early August, with prices rising to around BRL 140, fuelled by China substantially reducing its purchases of U.S. soybeans in response to tariff policies. According to the data from the U.S. Department of Agriculture, Chinese imports of U.S. soybeans dropped by 51% year-on-year in the first half of 2025. However, Brazilian soybean prices resumed their downward trajectory in the last weeks, with prices in Northern Mato Grosso falling to BRL 113 per 60 kg bag.

In terms of costs, data from IMEA shows that crop protection products registered the biggest drop, falling by 10.9% compared to the 2023/24 season. Fertilisers followed with a decrease of 4.71%. Nonetheless, amid the ongoing geopolitical crisis, nitrogen fertiliser prices have recently surged, particularly affecting nitrogen-based products (IMEA). According to Itaú BBA, the price of urea rose by 5.2% in July, reaching USD 455 per ton at Brazilian ports (Minuto MT).

Looking ahead, geopolitical risks could further aggravate the situation. Brazil is already facing trade tensions with the United States under the Trump administration, which has recently taken a tougher stance toward the country and sanctions on Russia could significantly disrupt fertiliser deliveries to Brazil.

These challenges are being compounded by supply-side pressures. Urea plants in Egypt have halted operations, Iran has reduced output amid the Israel–Iran conflict, and a Russian facility was damaged by a drone strike in July. In response, Brazil has increased fertiliser imports since June to secure the supply of this essential agricultural input. While this surge temporarily alleviates immediate shortages, it effectively postpones the impact of rising prices, meaning that inflationary pressures in the agricultural sector are likely to be felt more sharply in the future.

The non-GMO resurging

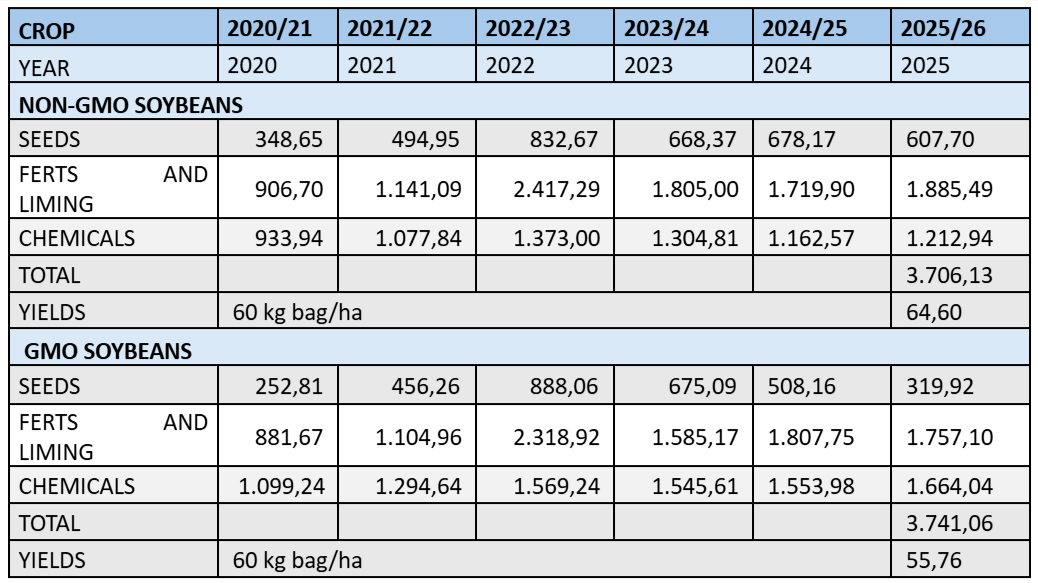

In a scenario characterised by uncertainty and shrinking margins, the non-GMO market offers exceptional attractiveness. According to the soybean production cost report by IMEA/SEMEAR, the combined costs of seeds, fertilisers and chemicals are slightly lower for non-GMO soybeans, while average yields are significantly higher.

Non-GMO versus GMO costs and yields in the state of Mato Grosso, the largest soybean producer state in Brazil.

Source: https://www.imea.com.br/imea-site/relatorios-mercado-detalhe?c=4&s=696277717805039616

Prospects for non-GMO production

Recent non-GMO soybean varieties have demonstrated exceptional performance, achieving yields that are comparable to, and sometimes surpassing, those of their GMO counterparts.

The non-GMO segment has a much smaller pool of seed suppliers compared to the diverse and widely distributed GMO market. Moreover, the top-performing non-GMO brand holds the largest market share within the segment, meaning its strong performance has a disproportionate influence on overall non-GMO yield statistics. In contrast, the performance of leading GMO seed suppliers is spread across numerous brands and sources, resulting in a less pronounced contribution to overall averages.

This concentration effect suggests that non-GMO statistics may reflect the success of a few dominant players, rather than uniform outperformance across the entire segment. High-performing non-GMO brands also have a significant influence on seed pricing. However, EMBRAPA’s non-GMO varieties deliver strong yields at almost half the cost of leading commercial brands, demonstrating that high productivity does not necessarily require the highest input costs.

Nonetheless, the data highlights the competitive potential of non-GMO seeds, showing their capacity to produce high yields in the current agricultural landscape, on par with genetically modified soybeans.

The current scenario is already driving significant changes in market trends. Unexpected volumes of non-GMO soybeans have been reported in Rio Grande do Sul and Paraná, despite the absence of consolidated buyer demand or associated market premiums. Farmers are increasingly choosing to plant non-GMO seeds due to the clear agronomic advantages, including stable yields, adaptability to local conditions, and reduced dependence on costly technology packages.

In Paraná, cooperative farmers have either transitioned back to non-GMO production or have continued with it, despite lacking access to premiums. These volumes are currently being sold through the regular commodity market to undifferentiated buyers, suggesting that production decisions are being driven more by agronomic rationale than by market demand.

These dynamics highlight both the opportunity and the challenge: stronger buyer engagement, premium-based incentives, and contractual stability will be essential to strengthen the long-term growth trajectory of the non-GMO segment. The premium market adds at least 10% (usually more) to regular soybean prices. The decline in non-GMO seed supplies over the past decade has primarily been due to the absence of consistent buyers and structured agreements. A market dominated by spot prices and short-term negotiation strategies has eroded the ability of seed developers and producers to plan, invest in, and sustain operations.

Although companies in the non-GMO segment tend to prioritise relationship-based models, the dominant trade practice still relies on immediate price signals. This undermines the development of long-term, resilient supply chains.

Now, as market conditions push for a revival of the non-GMO seed industry, the main obstacle to expansion is the limited availability of seeds. Nevertheless, if current trends persist, Brazilian non-GMO soybean production is expected to increase significantly in the 2026/27 season, creating an opportunity to rebuild a more structured, resilient, and competitive value chain.

Non-GMO soybean supply in Brazil: On-record and off-record figures

Historically, the production of non-GMO soybeans in Brazil has been largely driven by demand. Almost all production was destined for the export market, where producers received a premium under solid supply agreements with European buyers, such as feed producers purchasing soybean meal and crushers buying whole beans. Production was closely aligned with contractual demand, and supply chains operated within a stable and structured framework.

Over time, however, this landscape changed. Declining international demand and weakening contractual structures led to production becoming increasingly farmer-driven. Farmers were motivated less by guaranteed market outlets and more by the agronomic advantages of non-GMO seeds, such as yield stability, adaptability to local conditions, and lower input dependence. Consequently, growing volumes no longer entered certified export corridors, creating a widening gap between the total amount of non-GMO beans produced and those officially certified for export.

Brazil’s total non-GMO soybean production is currently estimated at around two million tons, a part of which is absorbed by the domestic commodity market. These volumes typically trade without the traditional European non-GMO premium, or in alternative market niches, such as the organic sector, where pricing dynamics differ significantly from those in the structured non-GMO industry in Europe.

This dynamic has been particularly evident in Paraná. Meanwhile, in Mato Grosso, smaller regional clusters of non-GMO production are operating “below the radar,” further reinforcing the existence of a parallel supply base independent of export certification systems.

Looking ahead, these “off-corridor” volumes present both a challenge and an opportunity. Without structured buyer engagement and robust certification mechanisms, much of this production is at risk of remaining confined to undifferentiated domestic markets and being absorbed largely at the farm level. However, if certification frameworks are reinforced and international demand regains momentum, these underutilised clusters could be swiftly mobilised, materially strengthening Brazil’s position in the global non-GMO soybean trade.

The non-GMO premium: Current mechanics and the need for transparency

The non-GMO pricing structure in Brazil has long been opaque. Premiums have fluctuated widely, from virtually zero to extremely high margins within the SPC chain, creating inconsistent expectations among farmers. While exporters have incentives to protect their market strategies and margins, this lack of clarity has sometimes resulted in damaging outcomes. Therefore, it is crucial to understand the particularities of the non-GMO premium structure:

- Non-GMO SPC vs. non-GMO Hipro: SPC is a non-commodity product, with farm-gate prices significantly higher than standard soybean meal. While the historical price of non-GMO Hipro has remained around USD 500 per ton, the price of non-GMO SPC often trades at USD 1,000 or more. In regions influenced by SPC producers, this can translate into premiums reaching USD 10 per 60kg bag – approximately USD 170 per ton at the farm gate – particularly during urgent export deliveries. However, under normal market conditions, prices are generally lower and more sustainable, even within the broader margins of SPC.

- Hipro constraints: In contrast, Hipro prices reflect much smaller margins. When inland logistics and segregation costs in Brazil are included, final delivery prices at European ports rarely exceed USD 150 per ton, resulting in significantly lower farm-gate prices.

The difference in premiums between SPC and Hipro often causes confusion among farmers. Exposure to unusually high SPC premiums can lead to unrealistic expectations, frustration and attempts to negotiate unsustainable prices in the long term. Such misalignments increase the risk of deals failing and production volumes going unsold, which disrupts the non-GMO supply chain.

There is a significant window of opportunity for the non-GMO industry, particularly along the Brazil–Europe corridor. Capturing this potential depends on active engagement from European buyers and disciplined, well-informed behaviour from Brazilian farmers. Without this engagement and behaviour, the opportunity risks being lost, allowing existing negative market indicators to dominate and undermine the growth trajectory of the non-GMO segment.

As the non-GMO soybean market continues to evolve, industry stakeholders are preparing to gather at the Non-GMO Soy Conference 2025. Organised by Donau Soja and the ProTerra Foundation, the event will take place on 4 November in Frankfurt. The event will bring together producers, traders, retailers and policymakers to discuss the latest trends, challenges and opportunities shaping the non-GMO supply chain. With a focus on sustainability, traceability and market stability, the conference promises to provide valuable insights at a pivotal moment for the global non-GMO sector. Further information can be found at nongmomarket.com.