New European Soy Report Highlights Progress and Challenges in Transition to Deforestation-Free Supply Chains

The Netherlands, 1 July 2025

A new report analysing trends in the European soy supply chain reveals both encouraging progress and persistent challenges in the shift toward deforestation- and conversion-free soy sourcing across the EU market as a whole (EU27+).

Efforts to source soy more sustainably have been increasingly adopted throughout the EU27+. The uptake of soy meeting the FEFAC Soy Sourcing Guidelines increased from 42% in 2019 to 54% in 2023. This increase is even more positive because FEFAC SSG now include conversion free criteria and reflect a growing commitment to responsible sourcing among European market actors.

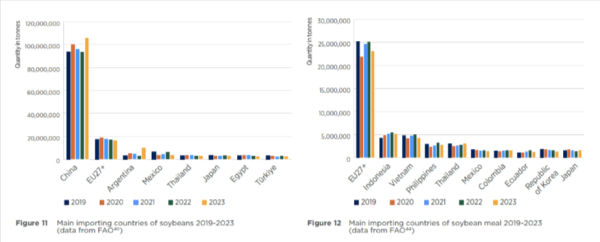

The European Soy Monitor 2022–2023 finds the uptake of certified sustainable soy in Europe remains heavily reliant on soy imports, particularly from high-deforestation-risk regions such as the Cerrado, Amazon, and Gran Chaco. The EU27+ is now the world’s largest importer of soybeans and the second-largest importer of soy meal after China, with European livestock production, especially pork and poultry, deeply dependent on these imports.

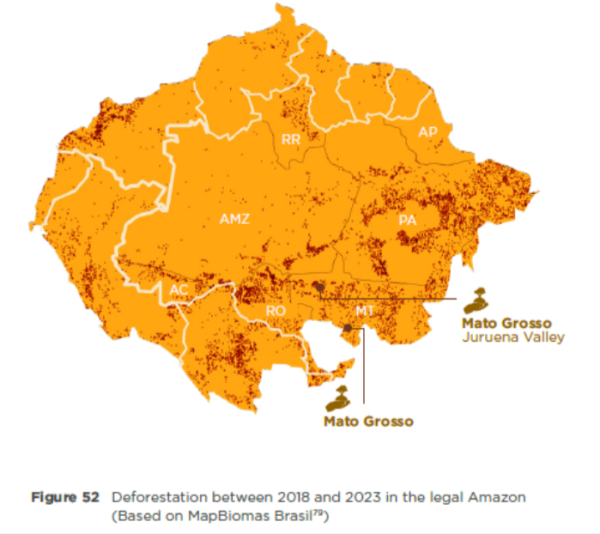

Between 2019 and 2023, global soy production rose by 10%, with a disproportionate share of this growth occurring in ecologically vulnerable areas particularly in high-risk biomes such as the Cerrado, the Amazon, and the Gran Chaco. These regions have experienced significant deforestation and land conversion, intensifying the urgency for responsible sourcing solutions.

The report emphasizes that certification alone is not sufficient. A broader suite of voluntary and mandatory solutions, including moratoria, landscape and jurisdictional approaches, clean supplier strategies, carbon footprinting, and public-private partnerships, is essential to scale up impact and ensure transparency.

Key Findings:

- Certified sustainable soy uptake rising: In 2023, the share of FEFAC Soy Sourcing Guidelines (SSG)-compliant soy rose to 54% in the EU27+.

- Persistent traceability gaps: While Southern European countries have shown stronger uptake of physical certified soy, others continue to rely heavily on book & claim (credit-based) models, leading to inconsistent traceability and assurance.

- Need for greater impact measurement to prove the efficiency of the Landscape and Jurisdictional Approaches: These approaches align well with corporate ESG strategies and can enable bulk sourcing of deforestation- and conversion-free soy. However, establishing effective measuring and reporting is an essential first step to demonstrate on the ground results and prove impact.

- Need for coordinated interventions: To halt deforestation and conversion, a combination of time bounded interventions, ranging from certification to clean supply chains and multistakeholder collaboration, are crucial to accelerating progress.

Early experiences in soy-producing regions in Brazil highlight critical success factors: strong government participation, multistakeholder involvement from the outset, local alignment with broader policy goals, and sufficient facilitation capacity.

In soy consuming regions, this needs to be matched by robust enforcement of laws, strong public and private commitments backed up by timebound action plans and public reporting, continued uptake of credible sustainability standards, and investment in landscape-level approaches that balance agricultural productivity with ecosystem preservation. Industry, governments, the finance sector and civil society must join forces to deliver coordinated action at scale, urgently and collectively, to protect vital biomes and secure a sustainable future for the global soy sector.

The report serves as a call to action to build on current momentum and deepen collaboration toward sustainable soy sourcing. With more robust alignment, time bounded commitments and improved traceability, the EU can play a pivotal role in reducing global deforestation and promoting environmentally responsible agriculture.